what is an example of an ad valorem tax

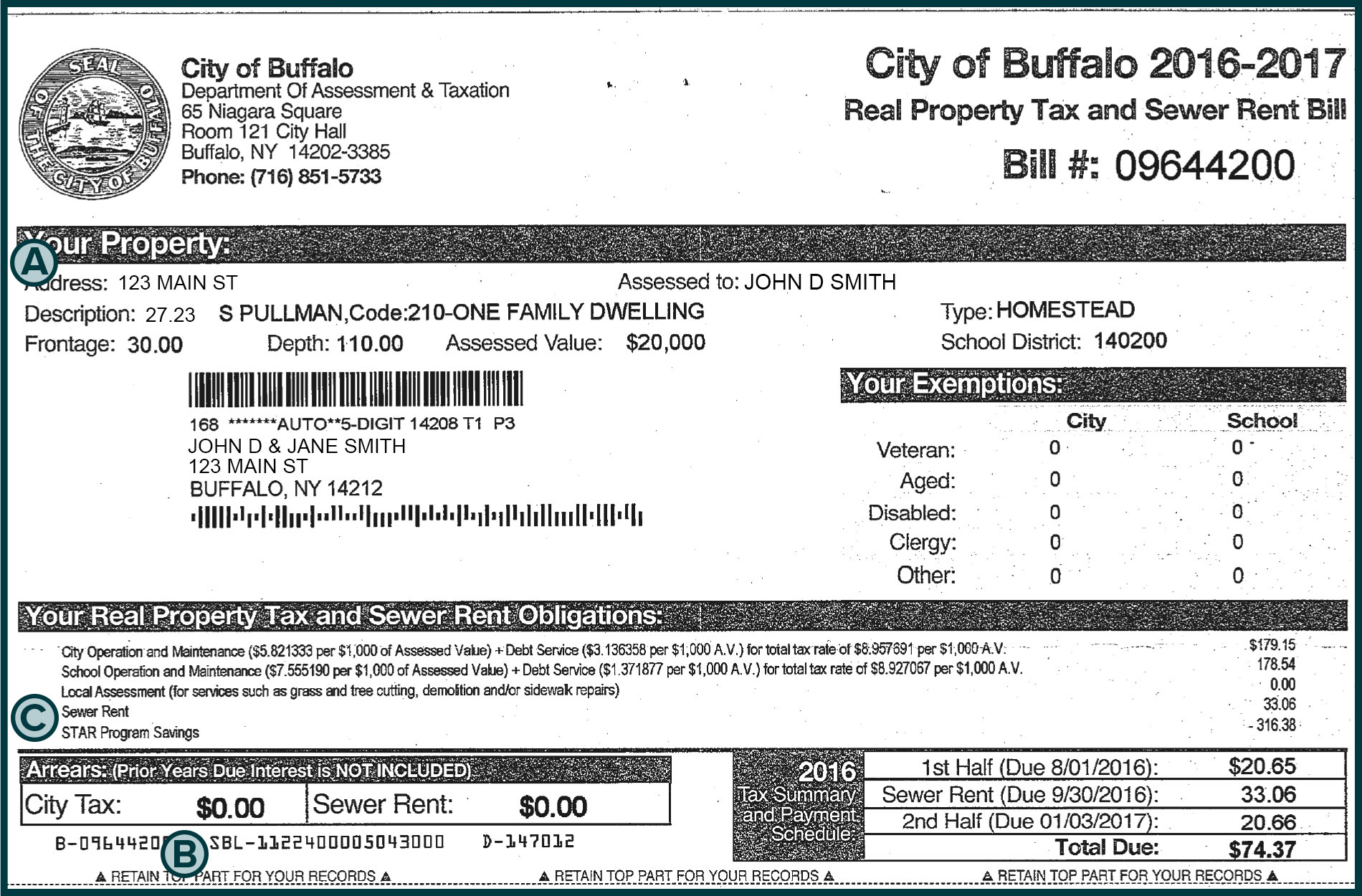

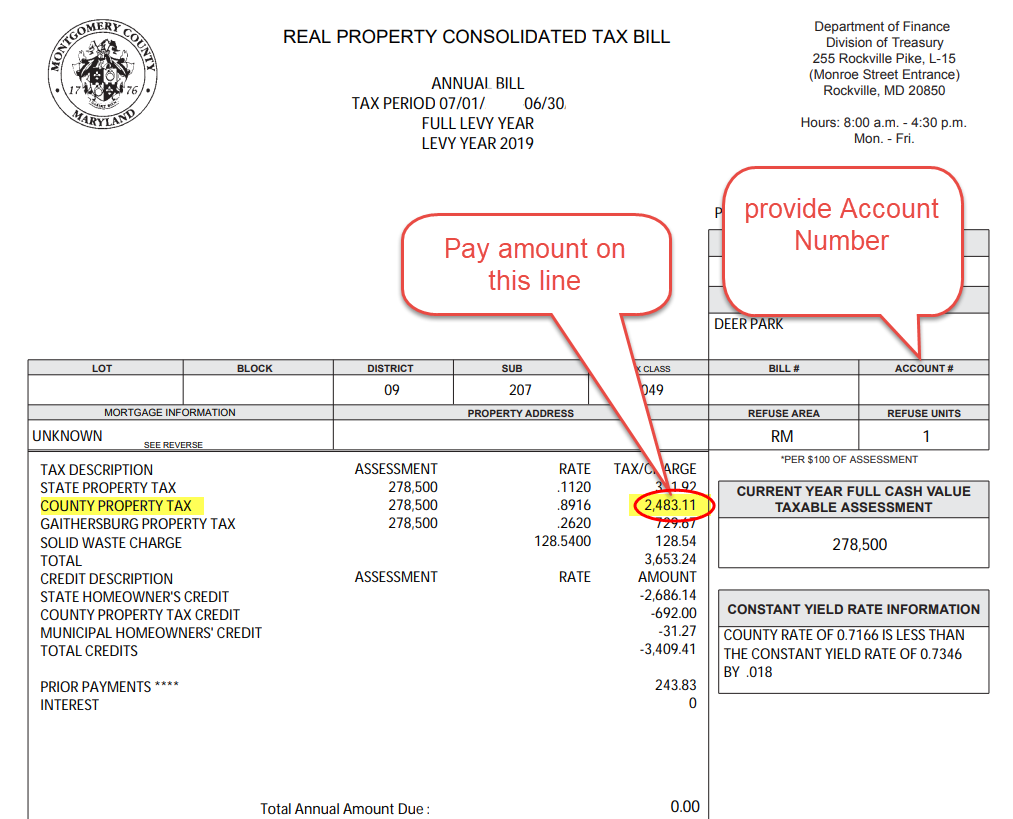

What is an example of an ad valorem tax is. A good example of the ad valorem tax is a local property tax which is assessed annually on the value of an owners residence and property.

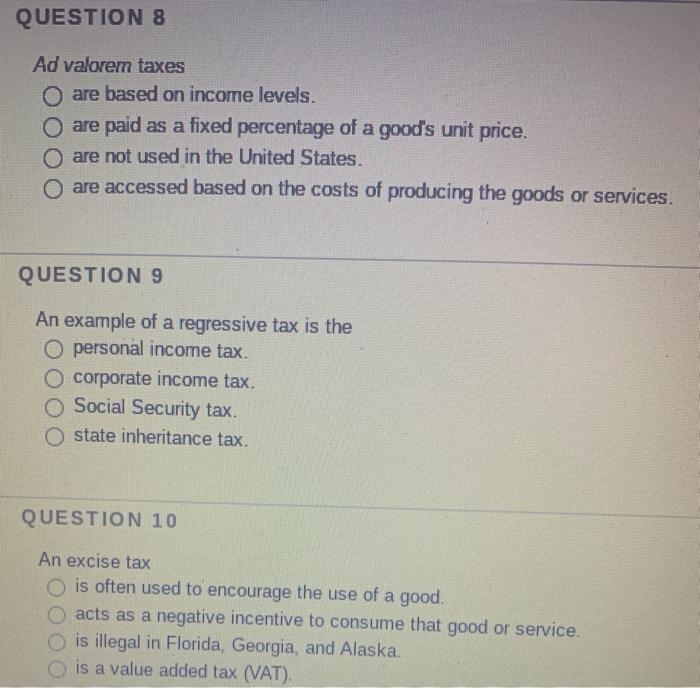

Solved Question 8 Ad Valorem Taxes O Are Based On Income Chegg Com

Homeowners property taxes are.

. You are essentially paying ad valorem taxes when youre paying your home property tax as it is based. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. The most common ad valorem.

What is an example of an ad valorem tax is. Stamp duty This is an ad valorem tax on buying a new house. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

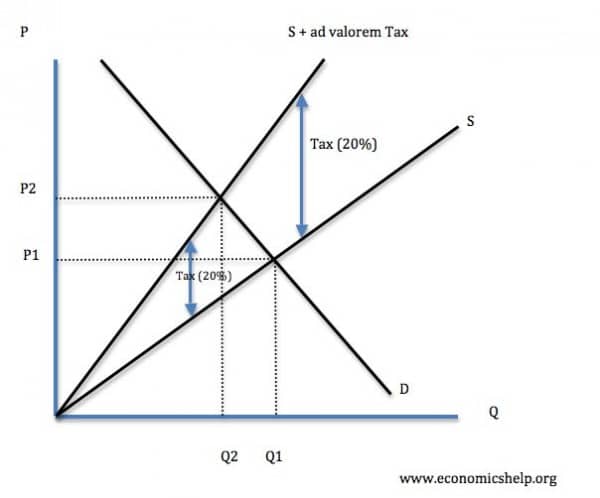

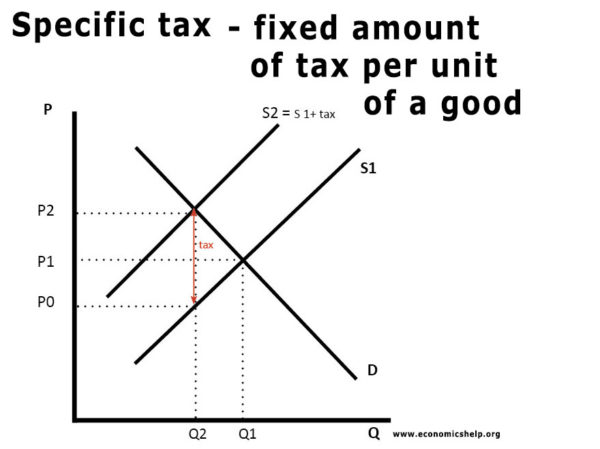

For example VAT is charged at a rate of 20 in the UK. 2 tax on purchases between. An ad valorem tax allows to easily adjusting the amount to be paid in any given occasion.

The most common ad valorem taxes are property taxes levied on. The most common ad valorem taxes are. Ad Valorem Tax.

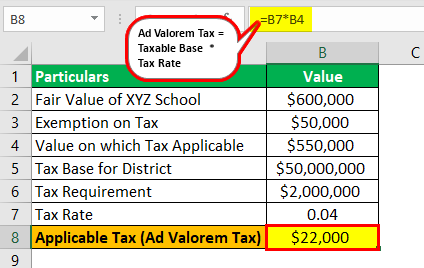

Imports are charged 8 exports 1 ad valorem duty. An ad valorem tax is a tax that is based on the assessed value of a property product or service. For instance if the market value of a 2000 square-foot home is 100000 the ad valorem tax levied will be based solely on the homes 100000 value regardless of its relative.

An ad valorem tax imposes a more comparable burden across both businesses. The most common example of ad valorem tax is property taxes. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

About 4000 were thus annually imported and an ad valorem duty was levied by the. Ad valorem sentence example. The name of the tax stems from a Latin phrase and means according to value.

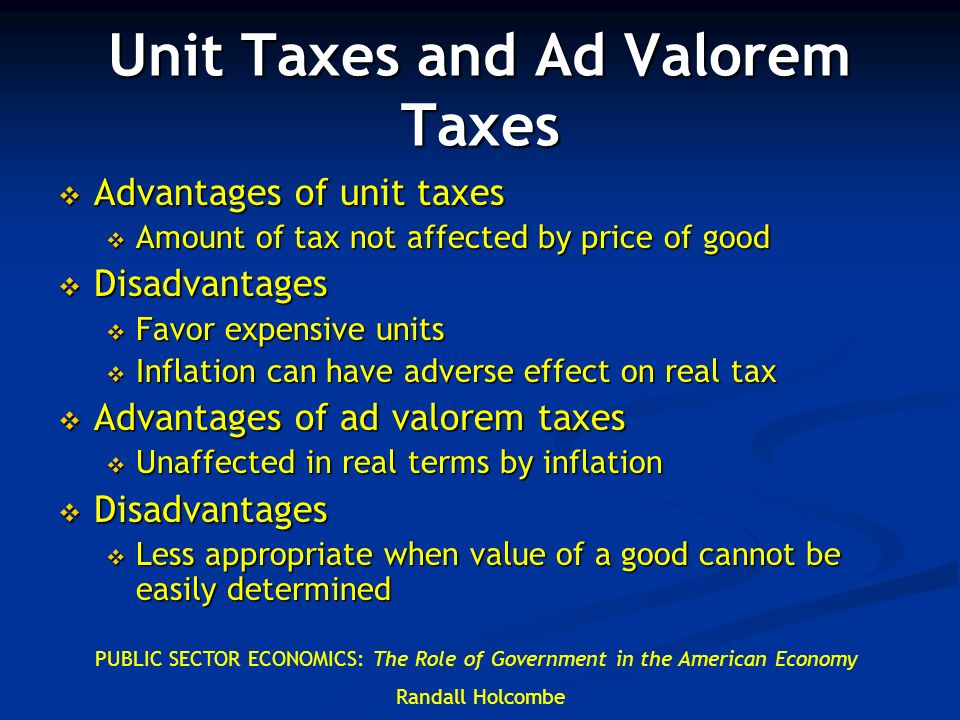

The most common ad valorem tax examples include property taxes on real estate sales tax on consumer goods and VAT on the value added to a final product or service. Examples of Ad Valorem tax 1. However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to.

The most common ad valorem taxes are property taxes levied on. An ad valorem tax is based on the value of an item at the time of the transaction or assessment. For example if this tax is applied to the value of a property every year the tax burden will increase.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. A 20 ad valorem tax increases production costs by 20 at each level of output if you. Local government entities may levy an ad valorem tax on real estate and other major personal property.

The marginal tax rates on new houses in the UK is. The most common ad valorem taxes are property. The most common ad.

Which of the following is an example of an ad valorem tax. An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad valorem.

An ad valorem tax is expressed as a percentage. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. An example of an Ad Valorem Tax Property tax is a form of ad valorem tax levied on the value of the real estate or other residential and commercial properties paid by the.

3 Examples of Ad Valorem Taxes.

Understanding California S Property Taxes

Ad Valorem Tax Explained Budgetable

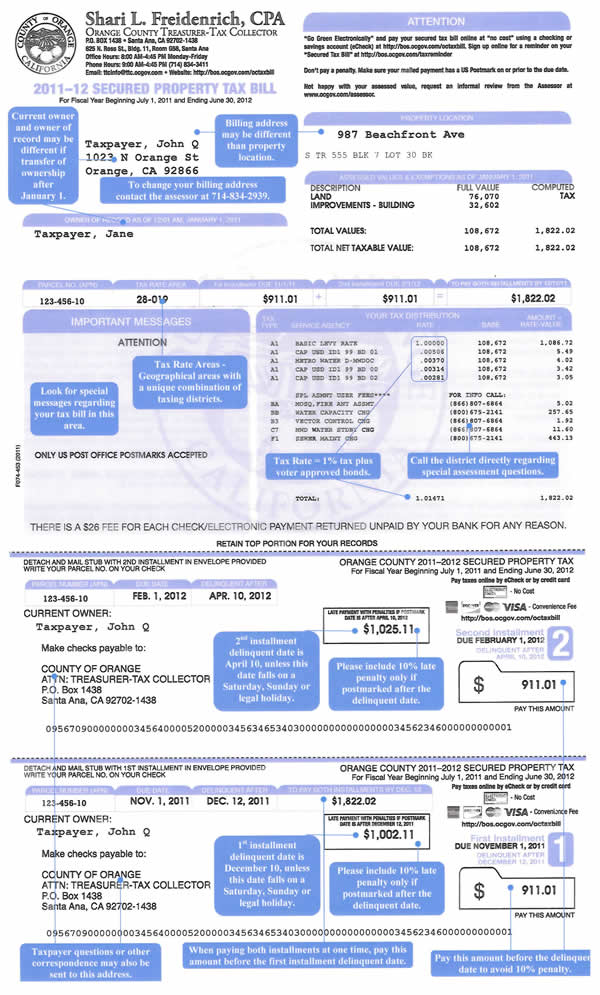

Secured Tax Bill Example Oc Treasurer Tax Collector

Ad Valorem Tax Definition Example Investinganswers

Tangible Personal Property State Tangible Personal Property Taxes

Chapter 12 Taxation And Income Distribution Ppt Download

8 Marks An Ad Valorem Tax Of 30 Applies To Nike Chegg Com

Ad Valorem Tax Meaning Types Examples With Calculation

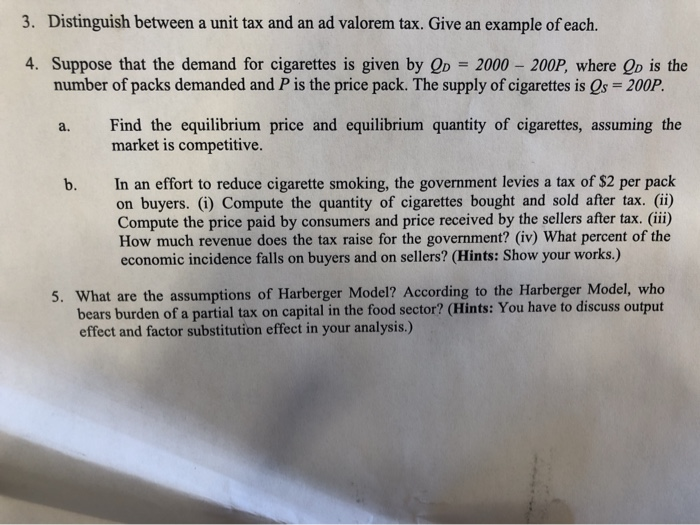

Solved Distinguish Between A Unit Tax And An Ad Valorem Tax Chegg Com

Property Tax Definition What It S Used For How It S Calculated

How Do State And Local Property Taxes Work Tax Policy Center

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

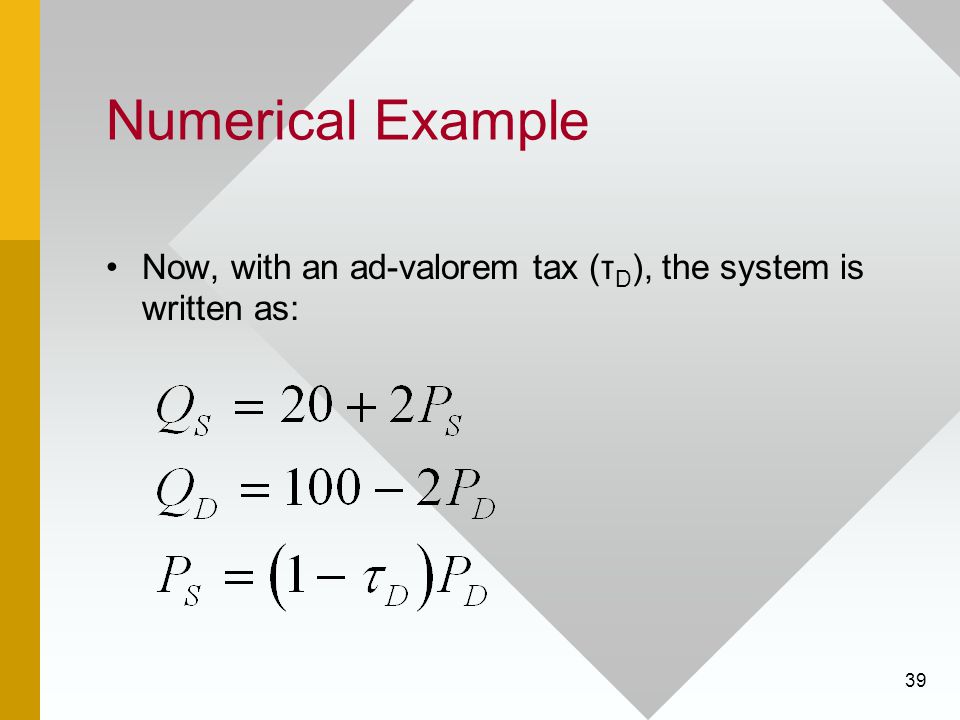

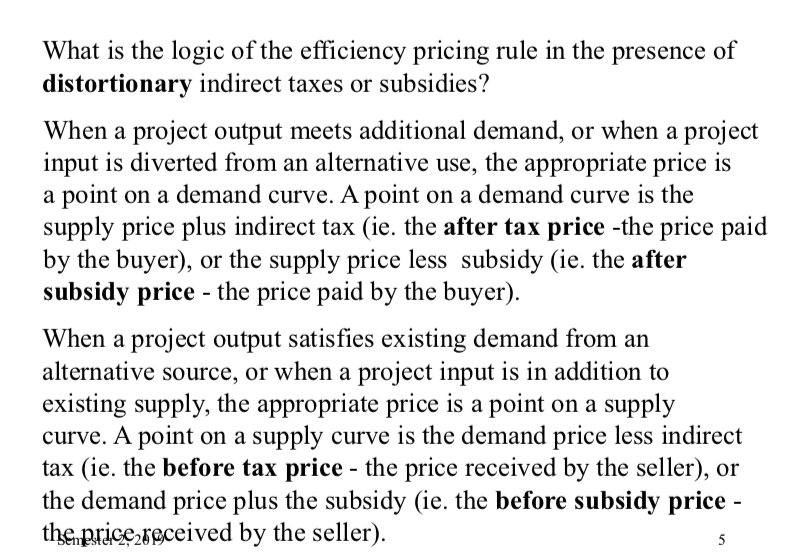

Excise Taxes Unit Taxes Ad Valorem Taxes Ppt Video Online Download